Artha Rin Adalat Ain 2003 Bangladesh Pdf Files

- Artha Rin Adalat Ain 2003 Bangladesh Pdf Files 2017

- Artha Rin Adalat Ain 2003 Bangladesh Pdf Files Download

- Artha Rin Adalat Ain 2003 Bangladesh Pdf Files Online

Artha Rin Adalat Ain 2003 Bangladesh Pdf Files Download Only financial institutions not anyone can file a case under the the ARAA 2003 for recovery of debts. Now, funded liability, so far I understand it, is that a person saves/invests/funds a certain amount for a liability he will incur in future as he has already promised it. Artha Rin Adalat Ain 2003 Bangladesh Ortho Rin Adalat Ain 2003 Bd After that in year 2000, ADR in civil procedure is the effect of success of Pilot project 2000 on mediation in Dhaka judge court and besides some other courts of Bangladesh.

- Artha Rin Adalat Ain 2003 English Version Pdf We are drifting into a stage of aimlessness, inertia, inaction and helplessness.any conscientious judges and lawyers have done what they could under the circumstances, but their sincerity has been drowned into the general morass of malfunctioning of the court system.

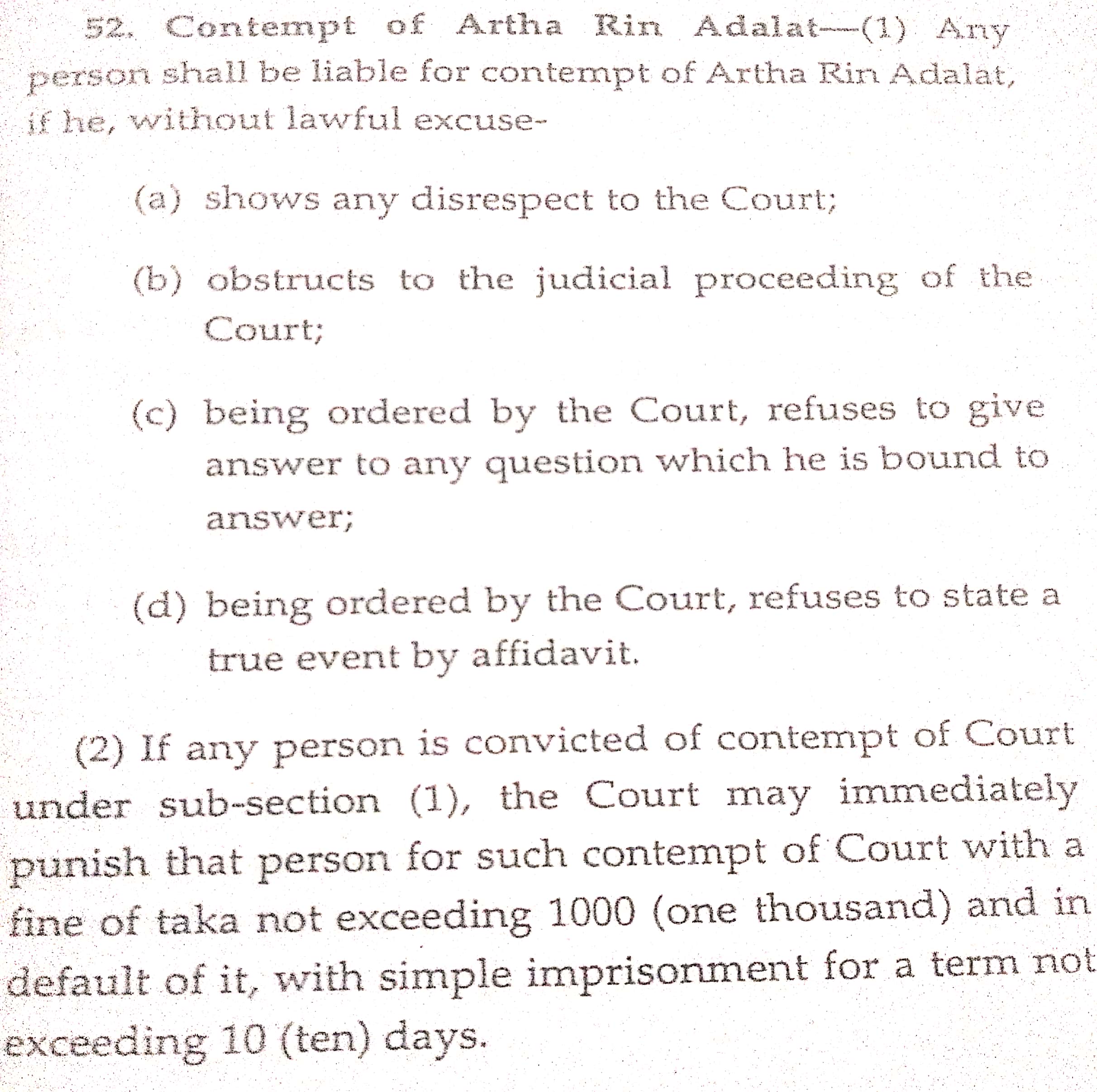

- Remedial provisions of Artha Rin Adalat Ain 2003. Government of Bangladesh case, following an Artha Rin suit, the petitioner filed a writ petition asserting that Section 41 1 2 of the Act is unreasonable, oppressive and arbitrary as it requires deposit of 50 per cent of the decretal amount at the time of preferring an appeal.

Analysis of Artha Rin Adalat Ain (ARAA) 2003. Cases involving claims by Bangladesh Krishi. If that financial provision files a case in Artha Rin Adalat.

TRANSCRIPT

Credit Risk Management of Pubali Bank Limited

CHAPTER ONE: INTRODUCTION1.1

INTRODUCTION

Financial institution like Bank is committed to provide high quality financial services/ products to contribute to the growth of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the youth, poverty alleviation, raising standard of living of limited income group and overall sustainable socio-economic development of the country. In achieving the aforesaid objectives of the Bank, Credit Operation of the Bank is of paramount importance as the greatest share of total revenue of the Bank is generated from it, maximum risk is centered in it and even the very existence of Bank depends on prudent management of its credit portfolio. Loans comprise the most important asset as well as the primary source of earning for the banking financial institutions. On the other hand, loan is also the major source of risk for the bank management. A prudent bank management should always try to make an appropriate balance between its return and risk involved with the loan portfolio. The failure of a commercial Bank is usually associated with the problem in credit portfolio and its less often the result of shrinkage in the value of other assets. As such, credit portfolio not only features dominant in the assets structure of the Bank, it is crucially importance to the success of the Bank also. Credit Risk Management process permits the banks to proactively manage loan portfolios in order to minimize losses and earn a satisfactory level of return for shareholders. So, Banks and Financial Institutions have high exposure to credit risk. To this consequence Pubali Bank Ltd has established its own credit policy to guide them in achieving their target of maximum value addition through an efficient and effective credit risk management. Prepared By: Pranab Chowdhury, SUST.

1.2 BACKGROUND

OF THE STUDY

The principal function of the bank is to lend. Lending comprises a very large portion of a banks total activities. Sound lending practice therefore, is very important for profitability and success of a bank. Like other financial intermediary, commercial banks also intermediate between the savers and borrower to mobilize the financial surplus of the savers and allocate these savings to the creditworthy borrowers of different sectors of the economy. As the banks do business by lending

Credit Risk Management of Pubali Bank Limited

their depositors' money, they have even more responsibility to manage their credit portfolio smoothly. Bank's reputation is a critical factor for its success and therefore modern banks must follow appropriate guidelines, policies and relevant manuals regarding credit extension and recovery. The usage of banking service for any type of financial activities is increasing day by day. People are taking loans to start different types of businesses. So management of credit portfolio is one of the major operations of the banks. Therefore, as a 1st generation bank, Pubali Bank Limited should give much attention to this area and this study will attempt to analyze their efforts and draw a complete picture of their practices.

1.3 SCOPE

OF THE STUDY

The scope of the study is entire Pubali Bank Limited. Pubali is the largest commercial bank in Bangladesh which has over 400 branches all over the country. I got an opportunity to work as an intern in this banks Kalighat Road Branch. Here I got chance to work different section of this branch. This report covered the overall Credit Risk Management of Pubali Bank Limited. It will not focus on the comparable credit practices of other banks. This report is a descriptive study which tries to focus on the theories and practices of credit risk management of Pubali Bank Limited.

1.4 SCHEDULE OF INTERNSHIPI was assigned for practical orientation at Kalighat Road Branch, Sylhet of Pubali Bank Limited. On the very first day at the Bank, I was welcomed by the Manager of Kalighat Road Branch, Mr Suman Chandra Das. During my practical orientation, I was guided by all the officers of the branch. They gave me some direction in choosing, schedule or orientation at various departments of the branch. Although I started with General Banking Department but after getting topic of my report from my supervisor, I fully started my task with credit department. The schedule, although not water-tight has given below: Date of Orientation 10 November 2011 - 05 December 2011 06 November 2011 09 February 2012 Departments General Banking Loans & Advances

Credit Risk Management of Pubali Bank Limited

Prepared By: Pranab Chowdhury, SUST.

1.5 OBJECTIVES

OF THE STUDY

The main objective of the report is to have an overview on credit approval and risk management techniques adopted by Pubali Bank Ltd, and the other objectives are as below:

To fulfill the partial requirement of BBA program; To have a sound understanding of credit risk management system and procedure followedin the Pubali Bank Limited;

To analyze in detail the credit risk management process of the bank and to makerecommendations if needed; and

To focus on the credit risk grading system for analyzing the credit assessment procedure ofPubali Bank Limited.

1.6 METHODOLOGY

OF THE STUDY

To prepare this report both the primary and secondary data were used. As a part of primary data collection, the manager and officers of the bank were interviewed. Customers have provided the primary sources of information. Furthermore the secondary sources of information were the different annual reports kept in the Bank. PRIMARY SOURCE: The primary sources include interviews with the bankers;

Face-to-face conversations with the respective officers and staffs of the Branch; Informal conversation with the clients; Various organizational procedures; Various unstructured papers and weekly report of the bank etc. SECONDARYSOURCES :

The secondary sources of data are the annual reports, general reports and official documents of the bank. Also different type of journal, selected books and other publications are used to enrich this report.

Devon ke dev mahadev all episodes and full. Credit Risk Management of Pubali Bank Limited

Study of the previous research report; Working papers, Office files, Printed forms; Different books and periodicals related to the banking sector; Newspapers and Internet; Annual Reports (2008, 2009, 2010) published by PBL. DATA ANALYSIS The credit risk management data of Pubali Bank Limited will be analyzed in a descriptive manner.

1.7 LIMITATIONS

Electrolux microwaves. OF THE STUDY

The limitations of the study are as follows:

The credit policies and manuals of PBL are of confidential nature and thus it is difficult tocollect the necessary literature and documents within this short time;

The bank officials though helpful in every respect do not have much time to explain theinternal procedures;

A structured filing procedure is often neglected which also poses difficulty inunderstanding the sequential procedure;

Borrowers do not often have the time to cooperate in the information gathering process; Non-availability of the most recent statistical data; Deficiency in data required for the study; Inaccurate or contradictory information and Time provided for conducting the study is another important constraint.

Prepared By: Pranab Chowdhury, SUST.

Credit Risk Management of Pubali Bank Limited

CHAPTER TWO: CONCEPTUAL FRAMEWORK2.0 CREDIT RISK MANAGEMENT: A THEORETICAL FRAMEWORKCommercial banks are in the risk business. In the process of providing financial services, they assume various kinds of financial risks. Contemporary banking organizations are exposed to a diverse set of market and non-market risks, and the management of risk has accordingly become a core function within banks. Banks have invested in risk management for the good economic reason that their shareholders and creditors demand it. But bank supervisors, such as the Bangladesh Bank, also have an obvious interest in promoting strong risk management at banking organizations because a safe and sound banking system is critical to economic growth and to the stability of financial markets. Indeed, identifying, assessing, and promoting sound risk management practices have become central elements of good supervisory practice.

2.1 CREDITIn banking terminology, credit refers to the loans and advances made by the bank to its customers or borrowers. Bank credit is a credit by which a person who has given the required security to a bank has liberty to draw to a certain extent agreed upon. It is an arrangement for deferred payment of a loan or purchase.(Wikipedia dictionary)

Credit means a provision of, or commitment to provide, funds or substitutes for funds, to a borrower, including off-balance sheet transactions, customers lines of credit, overdrafts, bills purchased and discounted, and finance leases.(Guideline on credit risk management, Bank of Mauritius)

2.2 CREDIT

RISK

Artha Rin Adalat Ain 2003 Bangla

Credit Risk Management of Pubali Bank Limited

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised(Wikipedia dictionary)

Credit risk means the risk of credit loss that result from the failure of a borrower to honor the borrowers credit obligation to the financial institution.(Guideline on credit risk management, Bank of Mauritius)

Credit risk arises from the potential that a banks borrower will fail to meet its obligations in accordance with agreed terms. Credit risk also refers the risk of negative effects on the financial result and capital of the bank caused by borrowers default on its obligations to the bank.(Risk Management Guidelines for Banks by Bangladesh Bank, February 2012)

The constituent elements of credit risk can be viewed from the following flowchart:

What is the risk that the bank does not fully recover the loan?

Cr edi t Ris k

Credit Risk Management of Pubali Bank Limited

Business riskWhat is the risk that the business fails to generate sufficient cash to repay the loan?

Security RiskWhat is the risk that the realized value of the security does not cover the exposure?

Industry risk

Company risk

Control risk

Cover risk

Supplies risk

Ortho Rin Adalat Ain 2003 Bd

Sales risk Position risk Management risk

Performance risk

Management competence risk

Management integrity risk

Figure 2.1: Flowchart of Credit RiskSource: Chowdhury, L.R., (2002), A Text Book on Banker's Advances, 2nd edition

BIBLIOGRAPHY1. Abeyrante, S. (2001) Banking and Debt Recovery in Emerging Markets: The Law Reform Context, Adlershot, Ashgate found in www.bog.us 2. Ahmed, S.M.H. (2004), Artha Rin Adalat Ain, 2003, 1st edition, New Warsi Book Corporation, Bangladesh. 3. Bangladesh Bank. (2004) Prudential regulations for consumer financing found in http://www.bangladesh-bank.org/

Credit Risk Management of Pubali Bank Limited

Artha Rin Adalat Ain 2003 Bangladesh Pdf Files 2017

4. Bangladesh Bank. (2005) Credit Risk Management: Industry Best Practices found in http://www.bangladesh-bank.org/ 5. Bangladesh Bank. (2012) Risk Management Guidelines for Banks found in http://www.bangladesh-bank.org/ 6. Bank for International Settlements Publications found in

http://www.bis.org/publ/pub_list.htm 7. Bank of Mauritius. (2003) Guideline on credit risk management found in http:// www.bom.mu.Guideline_on_Credit_Risk_Management.pdf 8. Basel Committee on Banking Supervision, (2000), Principles for the Management of Credit Risk, found in www.bis.org 9. Bernanke, B.S. (2006), Modern Risk Management and Banking Supervision, found in www, protiviti.com 10. Bhargava, A. (2000). Credit Risk Management Systems in Banks, found in www.sas.com 11. Burns, P., and Stanley, A., (2001), Managing Consumer Credit Risk, found in www.rmahq.org 12. Chowdhury, L.R., (2002), A Text Book on Banker's Advances, 2nd edition, Fair Corporation, Bangladesh 13. Credit Risk Grading Manual, June 2007 14. Focus Group on Credit Risk Management, (2005), Managing core risks in banking: Credit risk Management, Industry best practices, Bangladesh Bank found in www.bangladeshbank.org 15. Glantz, M. (2002), Managing Bank risk: An Introduction to Broad-Base Credit Engineering, Academic Press, California, US 16. Oesterreichische National bank. (2005) Credit Approval Process and Credit Risk Management, Otto Wagner Platz 3, 1090 Vienna, Austria

The New Peoplemaking expresses Satirs most evolved.Virginia Satir is considered to be one of the founders of the field of family. Download en contacto intimo virginia satir pdf descargar gratis.

Credit Risk Management of Pubali Bank Limited

17. Oesterreichische Nationalbank. (2004) Guidelines on credit risk management, Otto Wagner Platz 3, 1090 Vienna, Austria 18. Official Website of Pubali bank Limited on www.pubalibangla.com 19. Pirok, K. R. (1994), Commercial Loan Analysis: Principles and Techniques for Credit analysts and Lenders, Chicago, Probus Pub Corp. 20. Pubali Bank Limited. (2009) Credit Policy 21. Pubali Bank Ltd. (2010) Annual Report 22. Saunders, A. (1999), Credit Risk Measurement: New Approaches to Value-at-risk and other Paradigms, New York, Willy 23. The Federal Reserve Bank of NY: The Credit Process: A Guide for Small Business Owners

found in www.ny.frb.org/pihome/addpub/credit.html 24. Wikipedia, the free encyclopedia at en.wikipedia.org/

APPENDIXKey Financials as on 31 December, 2010 (Figures in million taka) Sl. 1. 2. 3. 4. 5. 6. Particulars Authorized Capital Paid-up Capital Reserve Fund & other Reserves Total Deposits Total Advances Total Investment 2006 5000 1200 3327.50 48675.93 40386.65 4982.10 2007 5000 2100 3832.09 57996.82 50549.17 5556.58 2008 5000 2940 4606.82 73016.51 61788.15 8375.59 2009 5000 3822 5687.25 88466.46 74203.33 12168.65 2010 10000 4968.60 9411.27 98850.50 89106.21 16516.39

Credit Risk Management of Pubali Bank Limited

7. Import Business 8. Export Business 9. Bridge Finance 10. Total Income 11. Total Expenditure 12. Pre-tax Profit 13. Net Profit 14. Total Assets 15. Fixed Assets Other Information 16. Number of Employees 17. Number of Shareholders 18. Number of Branches Earnings per Ordinary Share(tk.) 19. ( EPS for tk.10 Face Value)

37316.50 17701.80 7.14 5494.49 3684.43 1810.06 845.53 58401.14 1369.07 5141 11697 356 7.05

48345.41 19907.50 6.89 7087.63 4145.67 2941.97 1353.51 71560.66 1367.23 5270 19009 361 6.45

58009.10 24795.65 6.89 9009.25 5563.39 3445.86 1515.23 89884.70 1383.36 5321 24153 371 5.15

60493.85 24739.65 6.89 10663.81 6824.34 3839.47 2092.23 107579.6 1443.50 5375 30899 386 5.47

85683.53 33909.78 6.89 12828.53 7343.48 5485.05 3233.09 128462.6 3330.32 5534 86200 399* 6.51

Table 8: Key Financials of PBL on December, 2010 * According to the official website of PBL, current branch no is 406. Table 3.3: Deposit Mix Category Current deposit Bills payable Savings bank deposit Fixed deposits Short term deposits Pension schemes others Taka in million 16.79% 2.52% 34.10% 22.91% 11.91% 6.68% 5.09%

Table 3.4: Deposit Trend (Taka in millions) Year 2005 2006 2007 2008 2009 2010 Taka in million 44503.33 48675.93 57996.82 73016.51 88466.46 98850.49

Credit Risk Management of Pubali Bank Limited

Table 3.5: Advance Trend (Taka in millions) Year 2005 2006 2007 2008 2009 2010 Prepared By: Pranab Chowdhury, SUST. Taka in million 32639.68 40386.65 50549.17 61788.15 74203.33 89106.21

Copyright @ Ministry of Law, Justice and Parliamentary Affairs, Bangladesh. Act (1) Except in a suit under the Artha Rin Adalat Ain, (Amendment) Act, (Act No. . to be an arbitration agreement under section 9 of the Salish Ain. Artha Rin Adalat Ain Bangla 01 – Download as PDF File .pdf), Text File .txt ) or read online. This principle has been incorporated in the Article 27 of Bangladesh The Artha Rin Adalat Ain is related to the loan recovery process.

| Author: | Mezit Mikam |

| Country: | Comoros |

| Language: | English (Spanish) |

| Genre: | Music |

| Published (Last): | 10 May 2018 |

| Pages: | 334 |

| PDF File Size: | 1.49 Mb |

| ePub File Size: | 9.11 Mb |

| ISBN: | 490-4-74786-804-7 |

| Downloads: | 21754 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Tesho |

An application is not to be decided only on the basis of the provision of law mentioned in the application but on the basis of the materials contained in the application and an application is not banvladesh he rejected because of wrong mentioning of the provisions of law. Moreover, the notice as required under Order XXI, adtha 37 of the Code is also not indispensable, rather it was followed by a proviso where the Court preserved the power not to issue such notice if it comes within the knowledge that in order to cause delay the judgment-debtor has been adopting dilatory tactics.

Sections 47 and 50 2 —. Moreover, the rule of law is a priority of the government of Bangladesh. You can apply to the same Bench of the High Court Division for early hearing and vacate the order of stay.

Section 21 is an overriding provision, to which effect is to be given subject only to the satisfaction of the learned Judge of the Artha Rin that the procedure would be fit and proper in his discretion. So, there is no illegality or infirmity in the order of issuance of the certificate datedwhich is awaiting for registration under sub-section 8 of section 33 of the said Ain.

Section 50 2 —.

Thief calls police for help after getting locked inside car. Should the bank wait for 18 months to recover its money? Artha Rin Adalat, Khulna, the court decreed that the defaulter borrower cannot challenge the legality of Section 19 of the Act through filing a writ petition for enforcement of their fundamental rights.

What will be the status of a default borrower? But adalst, Honorable High Court Division, stayed the operation of auction notice dated Arab Bangladesh Bank Ltd. The fruitfulness or otherwise of the impending Settlement Conference is not a consideration to weight the mind of the learned Judge at the inspection of that procedure.

Remedial provisions of Artha Rin Adalat Ain 2003

Government of Bangladesh case, following an Artha Rin suit, the petitioner filed a writ petition asserting that Section 41 1 2 of the Act is unreasonable, oppressive and arbitrary as it requires deposit of 50 per cent of the decretal amount at the time of preferring an appeal. The normal steps for a civil suit that are to be adslat for cases under Artha Rin Adalat Ain are: Section 6 1 —. As such, it is in violation of the fundamental bangladeah of the borrowers under Articles 27 and 31 of the Constitution and it also breaches the human rights notions of access to justice and right to fair trial.

Now-a-days many decisions of the Supreme Court is delivered that needs further clarifications as it relates to the functions of banglacesh government or some financial organizations.

Thus, the provisions of section 51 and Order XXI, rule 37 of the Code are in conflict with the provisions of section 34 1 9 10 of the Ain.

If auction under section 12 of the Artha Rin Adalat Ain stayed by the High Court Division

banngladesh Banking sector passes year with sluggish deposits growth. Section 34 1 —. If the plaint has already been filed without the property being sold, then the plaintiff has to sell the property and adjust the loan and inform the court in written form [12 2 of ARAA]. It must be conferred by law either specifically or by necessary implication no application for review under Order 47 Rule 1 of the Code of Civil Procedure lies in the Artha Rin Adalat.

Moreover, this section is not applicable in case of said client, as the proceeding of filing suit has already started by issuance of ArthaRin Legal Notice dated Rule – 8 2 read with P.

Whether a revisional application or a writ will lie against an interlocutory order passed by Artha Rin Adalat. Artha Rin Adalat is a civil court having limited jurisdiction. Normally on the day of framing issues the court fix a date for final or peremptory hearing and then the trial stage begins without the need for fixing a separate date for bang,adesh a date for hearing. Sections 12 619, 20, 41 and 47 —. Such investigation is dispensed with only when the court considers the claim or objection was designedly or unnecessarily delayed.

Artha Rin Adalat Ain 2003 Bangladesh Pdf Files Download

The auction sale notice was published in the ‘Daily Sonar Desh’ on mentioning date of auction bangladseh on at PM but the property in question was not sold due to non-availability of the auction purchaser. Email required Address never made public.

Under section 26 of the Ain the provision of the Code is applicable so far as it is not inconsistent with the provisions of the Ain which includes the provisions of section 34 of the Ain. Now, all the ARAA says about procedures aon laid down in fourth chapter within section The Artha Rin Adalat suit shall not abate or dismissed rather it should be disposed on merit. The petitioner can only get any relief if, zrtha only if, the petitioner did not have any knowledge as to the exparte decree or as to the Jari Case.

The High Court Division nowhere in the order stated explicitly any bar from taking legal action that arises from other cause of action such as cheque dishonor under NI Act or CIB enlistment. And remember the favor of ALLAH upon you – when you were win and He brought your hearts together and you became, by His favor, brothers.

Moreso, the said provision stands for money decree passed in a Money Suit but not in a suit for recovery of bank loan which may also be called a money decree for which special law exists for the said purpose e.

Moreover, the time limit fixed by section 37 of the Ainfor disposal of execution case artya days being “directory” not “mandatory”, as atrha in Writ Petition No. Section 41 2 —. All the matters under this statute, as long as it is regarding recovery of loans by financial institutions, has to be entertained by Artha Rin Adalat of the relevant district.

Artha Rin Adalat Ain 2003 Bangladesh Pdf Files Online

Matters covered by this statute, its scope and jurisdiction of Artha Rin Adalat: The impugned order dated insorfar as it relates to warrant of arrest bangladesu hereby declared to have been made without lawful authority and is of no legal effect.

Act VIII of Section 17 1 2 —. Rule 8 2 of the Bangladesh Abandoned Property Land, Building and other Property Rules, though provides for ian of the property to the highest bidder in the open market but the said provision is only applicable in case of rejection under Article 15 of P.